Don’t enable unpaid invoices to drive a wedge between you and your prospects. As An Alternative, take care of excellent invoices professionally by following these easy steps so that nothing is left up within the air from the beginning. Ultimately, it’s up so that you just can resolve how strict your late charge policy is.

Use A Debt Collection Agency (60–90+ Days Overdue)

Nevertheless, the worth is nicely value it for some to benefit from this distinctive ability set—just make sure to consider all other options first. If all else fails, it might be time to enlist the help of debt collectors to recover the payment you’re owed. This is a relatively aggressive tactic and one that may injury your relationship with the client.

Methods To Manage And Collect Outstanding Invoices Effectively

![]()

If you do decide to enforce late fees on invoices, make sure that’s clearly outlined in the contract. Regardless, stay professional, but ensure you’re easy in your messaging. Situation B includes a disorganized enterprise owner who hasn’t prioritized AR administration. Upon reviewing buyer accounts, they realize that an bill from last month with web 30 cost phrases went unpaid. By the time they attain out to the client and payment is eventually accomplished and processed, it’s 45 days past due. That means it took 75 days to receive the funds because the goods or companies have been offered.

- This can make it more difficult and expensive to obtain financing from banks and other lenders, as they could view the enterprise as a better credit danger.

- Failure to pay the invoice by this date results in the bill becoming overdue.

- Incentives don’t always need to be financial; providing priority service or future discounts may additionally be efficient rewards.

- When invoices go unpaid, it disrupts your cash move and impacts your bottom line.

If the due date for fee is approaching, send a payment reminder e-mail to the shopper to make sure they’re aware of the approaching deadline. On the other hand, an overdue invoice is an unpaid invoice that’s past the due date, but the seller has but to obtain the outstanding quantity. Grasp invoice cost terms to safe cash flow, stop monetary pressure, and enhance your small enterprise’s stability and growth. A few small habits can make a giant distinction in managing overdue invoices.

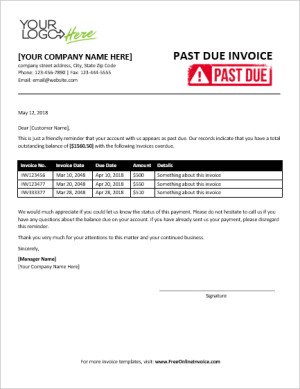

If a payment turns into overdue, send a formal overdue bill with clear cost directions. The language should be firm but well mannered, reiterating the cost terms and any extra charges that apply. Sometimes, the vendor should embody the due date by which they count on the customer to pay the excellent quantity. Between this time-frame, the bill is taken into account an outstanding bill before the customer makes the cost.

Credit Score Cloud

Generally, a busy client merely wants a extra obvious reminder to pay you. An effective means to do that visually might be sending an ‘overdue’ bill. Service and the quantity you charge, but an invoice uniquely consists of additional information related to the sale, similar to payment deadlines and cost options.

An invoice with a clear construction and simple cost phrases, including late cost charges and/or early cost discounts, can encourage timely payments. Outstanding invoices are a standard part of enterprise, but untracked invoices can quickly flip into overdue invoices. A proactive approach ensures well timed payments and keeps cash circulate stable. Based Mostly on these insights, regulate your method by improving contract phrases, enhancing communication strategies, or using higher tracking instruments.

Your gentle reminders can help maintain https://www.quickbooks-payroll.org/ them within the loop and forestall your bill from ending up on the back burner. If you might be owed cash over significant intervals, the worth of the cash your purchasers owe you presumably can change. Statistics have proven that money that is overdue by 90 or extra days can sometimes be worth 20% of the original worth. As Soon As you’ve recorded your invoices, you possibly can conveniently hold track of your accounts receivable within the dashboard.

One consumer describes Ramp as one of the best ways to handle enterprise funds, highlighting its robust AP and expense administration capabilities. These policies should be clearly stated on invoices, sales agreements, or buyer contracts. Often reminding clients about these terms can encourage them to take advantage of discounts—or keep away from penalties altogether. Modern technology offers powerful tools to automate, monitor, and enhance your invoice management and assortment processes.

This includes preliminary contracts, subsequent amendments, and any records of verbal agreements. Maintaining meticulous information not only Outstanding Vs Past Due Invoice helps prevent misunderstandings but additionally provides a robust foundation ought to you want to pursue legal action. While legal motion should at all times be a final resort, knowing your rights and having the mandatory documentation prepares you to deal with complicated situations effectively.