Understanding your mounted prices is certainly one of the most essential steps in managing your business. Whether Or Not https://www.quickbooks-payroll.org/ you’re budgeting, setting costs, or analyzing profits, fixed prices inform you what expenses you have to cover — even when you don’t promote a single thing. This can lead to incorrect pricing and would not contemplate that marginal cost—or the price to supply one more unit impacts profitability after fastened prices are covered. They’re based mostly in your loan’s interest rate and the principal amount you owe. Loan funds typically embody the enjoying off the principal balance, plus interest, and they don’t change unless you re-negotiate together with your lender or refinance the mortgage. The monthly quantity you owe your landlord doesn’t fluctuate primarily based in your sales or manufacturing ranges.

How To Calculate Fastened Costs: A Complete Guide For Companies

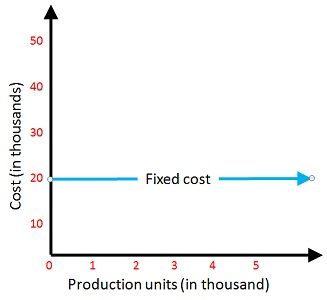

It helps businesses decide the level of sales needed to cover all fixed and variable costs. Examples of fastened costs include lease, insurance, and depreciation, which remain steady over time. Variable costs embody uncooked materials, packaging, and direct labor, which increase as extra items are produced or bought. To determine mounted and variable costs, first listing down all of the bills in the production of products or providers. Fastened costs are fixed and don’t change with the extent of manufacturing, whereas variable costs change depending on the quantity produced.

- For example, businesses with significantly greater administrative prices could have less profit whatever the variety of units they promote.

- These costs are fixed over a specified time and the amount doesn’t change with manufacturing output levels.

- For example, the entire fixed price will help with budgeting and pricing.

- By taking management of mounted costs, you probably can mitigate the danger of cash flow issues that may come up from surprising expenditures.

- Examples of short-term mounted costs include lease, insurance premiums, and salaried worker wages.

Depreciation

In this case, funds are primarily based on a 30-year schedule, however at the end of the 10-year time period, the remaining steadiness (a balloon payment) have to be paid off or refinanced. To conclude, I wish to say that preserving a detailed eye in your fastened costs is significant, and this is the place accounting software like Deskera Books would be of help to you. In this case, your on-line retail store’s mounted costs amount to $10,500 per thirty days. By leveraging these features, companies can gain better management over their value buildings, improve financial planning, and improve total profitability.

Variable Cost Ratio

This is why giant companies that promote high-demand items and companies, similar to Walmart, can have low costs while nonetheless making a revenue. Their common fixed price per unit decreases significantly due to the size of manufacturing output. If you wish to arrive on the fixed value per unit, you divide the entire mounted costs by the total models produced. Divide the total variable prices incurred by the variety of models produced during that period. For example, this might imply dividing the price of supplies by the items your organization produced with those materials.

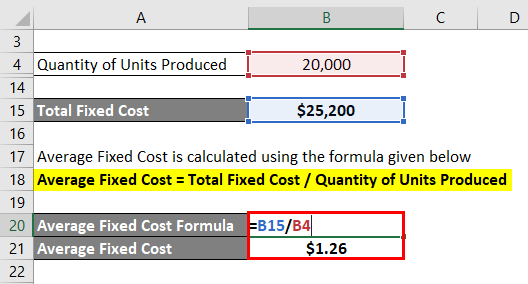

By figuring out your complete variable costs and total fixed costs, you may make higher enterprise selections. Analyzing break-even points helps corporations understand when their manufacturing price will equal income, after which they will start making earnings. They calculate the break-even level by dividing whole mounted prices by the distinction between revenue and variable costs per product unit. Common mounted cost is an amount that’s incurred to produce a unit or a service no matter what number of of them are offered. It is because of this that common fixed costs are essential and helpful for the pricing of your items and services.

This step involves creating a list of annual fixed and variable expenses your organization pays. Think About a small candle manufacturing enterprise spending ₹ 20,000 monthly on fixed costs. Preserving fixed prices under control is probably considered one of the high priorities for CFOs, particularly for reaching the break-even level.

Hence, if you want to make a profit, you now know that your retail price will have to be greater than $1.forty nine per t-shirt. Calculating common mounted costs is easy and important for understanding a company’s financial health. In this part, you will be taught the method and the step-by-step process of calculating the common fixed price. Fastened costs are expenses that do not change with will increase or decreases in a company’s production or sales volumes.

In easier terms, it helps to understand how a lot of the product or service you must promote to cover your prices. The breakeven level is the point at which your revenue is zero because all of your costs equal the amount of sales you’ve made. Mounted costs play a key function in pricing technique, as companies need to set costs that cover both mounted and variable prices to ensure How To Calculate Fixed Cost With Examples profitability.

These costs don’t change primarily based on sales volume and are therefore mounted. The breakeven point is a crucial monetary indicator that helps businesses perceive their minimal viability threshold. Whether Or Not in manufacturing, retail, service industries, or funding contexts, knowing precisely the place income meets expenses offers a crucial perspective for decision-making. Imagine a enterprise promoting smartphones at ₹ 16,000 and investing ₹ forty lacs to open a new manufacturing plant. Calculating all fastened expenses and margins per smartphone helps them evaluate the minimal number of smartphones they have to promote to make income.

For instance, institutions that sell alcohol want to apply for and renew their liquor license annually. It represents the compensation given to the personnel employed within the workplace and manufacturing. By combining AI with ERP, businesses gain a smarter, more proactive way to control prices and boost profitability. When you hit enter, you will see the fixed price equaling $26,000, the identical quantity you calculated with the first method.